Table of Contents

Imagine sending money overseas instantly, without your bank and without hefty fees – just through the power of code. It sounds like magic, but blockchain technology makes scenarios like this possible. In 2009, an anonymous developer named Satoshi Nakamoto mined the first block of Bitcoin and announced: “We have proposed a system for electronic transactions without relying on trust”. This breakthrough meant that, rather than trusting a single institution, the network of computers could share a single immutable, transparent ledger. People all around the world are already using blockchains, sometimes without realizing it – from paying with cryptocurrency in a café to buying unique digital art (NFTs) online, or even participating in blockchain-based games and apps. The technology is quietly transforming everyday life.

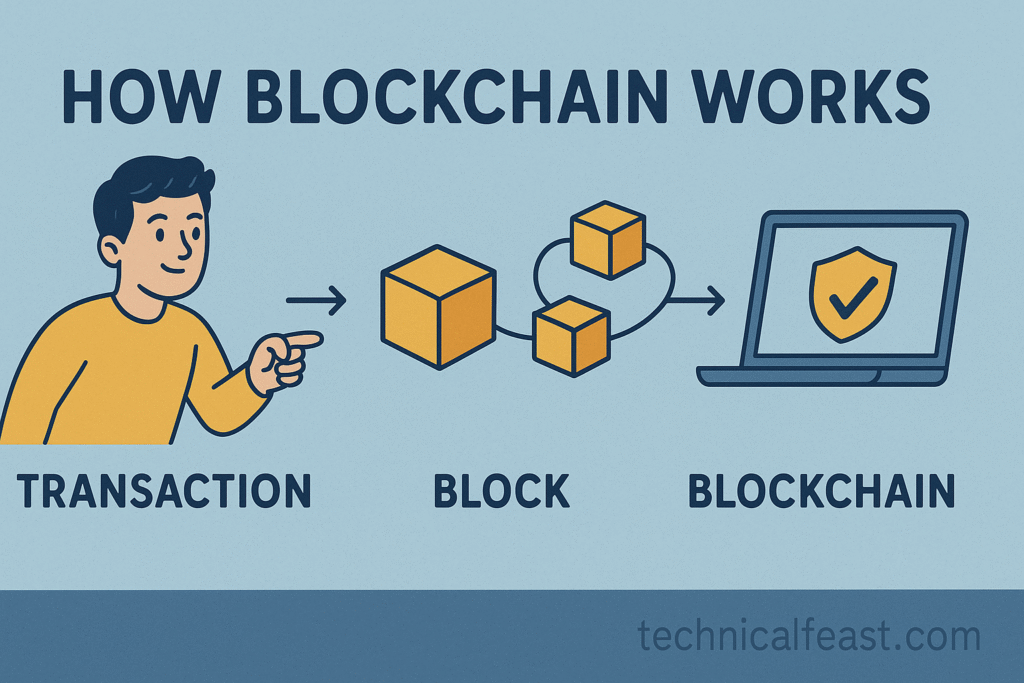

A conceptual visualization of a blockchain network of blocks and links. Each block contains a batch of transactions and is cryptographically linked to the previous one, forming a secure chain. This design is highly tamper-resistant: to alter one block, you’d have to change every block after it on every copy of the chain simultaneously. Each block also holds a unique digital fingerprint (a hash) plus the hash of the prior block. In practice, if even a tiny detail is altered, the hash changes and the chain’s links break. That is why blockchain entries are effectively permanent once confirmed. In other words, blockchain technology replaces blind trust with math and transparency – it’s like Google Docs on steroids, where all participants instantly see every update and cannot secretly rewrite history.

History of Blockchain

The idea of a shared, tamper-proof ledger goes back decades. In 1982, cryptographer David Chaum first proposed the concept of a “computer system… trusted by mutually suspicious groups”. In 1991, Stuart Haber and W. Scott Stornetta built a practical system to time-stamp digital documents in an unbreakable chain. By 1992 they added Merkle trees to pack many records into each block efficientlyen.wikipedia.org. These innovations were early hints of what blockchain could become.

The real breakthrough came in 2008 with Satoshi Nakamoto’s Bitcoin whitepaper. Satoshi took these cryptographic ideas and applied proof-of-work block chaining to money. He wrote of “a system for electronic transactions without relying on trust”. In January 2009, the first Bitcoin block (the genesis block) was mined and Bitcoin’s ledger was born. Within a year, Bitcoin’s first real-world transaction occurred (10,000 BTC for two pizzas), proving the concept in practice. Bitcoin’s success then inspired hundreds of altcoins, each experimenting with new features. Notably, in 2015 Vitalik Buterin launched Ethereum, adding programmable smart contracts to the blockchain and vastly expanding its potential uses beyond currency. By 2016 the term “blockchain” had entered mainstream vocabulary as a single word. From these roots, blockchain technology has grown into a whole new industry.

How Blockchain Works

At its core, a blockchain is a chain of data blocks. Each block contains a batch of transactions, a timestamp, a cryptographic nonce (in proof-of-work chains), and the hash of the previous block. When someone wants to add a transaction, the network’s computers (nodes) first validate it and then bundle many transactions into a new block. That block is then verified by consensus across the network. For example, in Bitcoin’s Proof-of-Work system, miners race to solve a difficult puzzle; the first to solve it adds the block and earns a reward. In Proof-of-Stake systems, validators are chosen in proportion to their stake in the currency. Once a block is validated and added, it is broadcast to everyone and time-stamped. Every copy of the ledger is updated with the new block, maintaining a synchronized record worldwide. Even if some nodes go offline or are attacked, the network continues as long as a majority stay honest.

Key features of blockchain technology include:

- Decentralization: No central server controls the data; it’s spread across many computers (nodes). This removes single points of failure. Even if some nodes fail, others maintain the network.

- Immutability: Once data is written into a block, it’s nearly impossible to change without altering every following block on every copy of the ledger. This makes falsifying past records unfeasible.

- Transparency: On public blockchains, anyone can inspect the ledger. All transactions are open for verification, building trust among participants who may not know each other. (It’s truly like Google Docs for money.)

- Security: Strong cryptographic hashing and consensus methods protect against tampering. If you try to change one block, every subsequent block’s hash no longer matches, and the network rejects the alteration.

Types of Blockchain

Blockchains come in several “flavors,” each tailored to different use-cases. The four main types are public, private, consortium, and hybrid blockchains:

- Public (Permissionless): Anyone can join a public blockchain without approval. Bitcoin and Ethereum are classic examples. These networks are completely open (anyone can send transactions or help validate the ledger). Public blockchains emphasize decentralization and transparency. They typically rely on economic incentives (like mining rewards) to secure the network, and use consensus (PoW or PoS) among anonymous participants. The downside is scalability: public chains can be slower (because every node must process transactions) and early systems used lots of energy.

- Private (Permissioned): A private blockchain is restricted to one organizationen.wikipedia.org. No outsider can join or read it without permission. For example, a company might run a private blockchain for its internal records or auditing. These are faster and more scalable because they involve fewer nodes and can use simpler consensus (trusted entities agree). The trade-off is decentralization: since one entity controls the network, it can change rules or data if it wanted (so critics say it’s not truly “trustless”).

- Consortium (Federated): Here a group of organizations jointly operate the blockchain. It’s still permissioned, but not owned by a single company. Think of a consortium of banks or supply-chain partners. Consortium blockchains balance trust and efficiency: they’re more decentralized than a private chain but more controlled than a public one. For example, JPMorgan’s Quorum and IBM’s Hyperledger projects use this model. Many banks and consortia use this approach for interbank settlements or trade finance, letting members share a ledger in real-time while restricting outsiders.

- Hybrid: Hybrid blockchains blend public and private features. Part of the network might be open to outsiders, while sensitive data remains restricted. For instance, a company might store confidential data in its private blockchain, but publish only cryptographic hashes to a public chain for auditability. This setup lets organizations gain transparency (via the public part) without sacrificing privacy or control (in the private part).

Each type serves different needs. Public blockchains fit open value transfers (like global digital currencies). Private/consortium chains suit enterprises needing privacy (like supply-chain tracking or record-keeping).

Some real-world examples:

- Supply Chain: Retailer Walmart, in partnership with IBM, built a blockchain (using Hyperledger Fabric) to trace produce. Tracing a package of mangoes to its farm took 6 days with old methods. Using the blockchain system, it took only 2.2 seconds. This drastically improved safety and recall speed for everyone in the network.

- Finance: Banks are piloting consortium blockchains to speed up back-office processes. For example, many financial firms collaborate on platforms like R3’s Corda or Quorum to share transaction ledgers and settle trades in real time.

- Healthcare: Estonia, a leader in digital governance, uses blockchain to secure patient health records. The government adds patient data to a blockchain to ensure records can’t be tampered with. This adds an extra layer of integrity to citizen data.

- Digital Identity & Voting: Countries like Estonia also explore blockchain for e-IDs and voting to give citizens control over their data and build audit trails. Pilot projects have even tested blockchain voting to increase election transparency.

- Other Industries: Blockchain is used in energy trading (peer-to-peer solar power markets), in media (rewarding content creators on platforms like Steemit), in digital art (NFT marketplaces verify and transfer ownership on-chain), and in charities (tracking donations to ensure they reach the right people). In each case, blockchain technology provides a shared, immutable record that builds trust among participants.

The Future of Blockchain Technology

The future of blockchain technology is bright and rapidly evolving. Industry analysts and experts are optimistic. Gizel Gomes of CTO Magazine summed it up: “The future of blockchain technology is promising due to its potential to reshape industries, enhance security, reduce fraud, and promote transparency”. IBM’s Ginni Rometty famously said blockchain will “do for trusted transactions what the internet did for information”. In short, many see blockchain as a foundational technology with far-reaching impact.

Major trends are underway. One is DeFi (Decentralized Finance): blockchain is transforming banking by allowing peer-to-peer lending, borrowing, and exchanges without middlemen. Platforms like Aave and Compound let anyone with crypto earn interest or take loans via smart contracts. DeFi grew explosively in 2020–21, with tens of billions of dollars locked in these protocols at its peak – a sign that people are eager to use blockchain for finance. Another trend is the integration with other tech: combining blockchain with the Internet of Things (IoT) could let smart devices transact and verify data securely. Even artificial intelligence and blockchain may converge in “smart” systems that automate decisions with transparent audit trails.

Blockchain is also on the radar of governments. Many central banks are researching or piloting Central Bank Digital Currencies (CBDCs) on blockchain-like platforms to issue secure digital cash. In the environmental sector, the World Economic Forum highlights blockchain as an “essential tool” in the race to net zero. For example, blockchain can transparently track carbon credits or renewable energy generation, ensuring companies meet climate targets. The United Nations has noted blockchain’s potential to improve transparency and efficiency in achieving sustainability goals.

Scalability and interoperability are improving. New blockchains and “Layer-2” solutions handle thousands of transactions per second (far more than early chains), and bridges allow different blockchains to share data. Ethereum’s shift to Proof-of-Stake and sharding makes it far more energy-efficient. Meanwhile, projects like Lightning Network (for Bitcoin) enable instant micropayments off-chain. These innovations aim to make blockchain technology practical for mass adoption.

Despite challenges – like evolving regulations, technical complexity, and energy concerns – momentum is undeniable. PwC estimates blockchain could generate over $3 trillion in business value by 2030. Visionaries like Marc Andreessen argue the impact could be revolutionary. As Andreessen wrote, Bitcoin’s breakthrough “gives us… a way for one Internet user to transfer a unique piece of digital property to another” without intermediaries, and “the consequences of this breakthrough are hard to overstate”a16z.com.

In summary, blockchain stands to become a defining force of our digital future. It promises a more open, efficient, and secure world of technology. Whether by enabling peer-to-peer finance, tracing supply chains, democratizing data, or creating new forms of digital ownership, its potential impact is vast. This revolution may sound like science fiction, but its early successes are real – and we are witnessing just the beginning of where blockchain technology can take us.

Optimistically looking ahead: Many innovations already use blockchain. The Bitcoin (left) and Ethereum (right) coins in this image rely on their blockchains to record every transaction. In the background is a price chart, hinting at how blockchain has enabled new markets (cryptocurrencies, tokens, DeFi) to flourish. As these applications grow and diversify, blockchain technology continues to unlock new possibilities for finance, digital assets, and beyonda16z.com.

Conclusion

Blockchain technology is set to become a defining force in our world. It offers a more open, efficient, and secure way to record information and transfer value. We’ve seen it enable peer-to-peer payments, secure voting trials, auditable supply chains, new digital marketplaces, and more – all without traditional middlemen. This shift empowers everyday people and organizations by replacing blind trust with transparent rules and cryptography. As Marc Andreessen noted, blockchain’s potential “are hard to overstate”a16z.com. We are witnessing just the beginning of this revolution. Staying curious and informed will let us ride the wave of innovation that blockchain technology is creating – one block at a time.

FAQ

- What is blockchain technology?

Blockchain technology is a method of storing data in a distributed digital ledger. This ledger is shared across many computers (nodes), so that each participant has a synchronized copy. Each block in the chain contains records (like transactions) linked by cryptography to the previous block. Once data is confirmed on the blockchain, it is extremely difficult to change without altering all subsequent blocks. You can think of it like a public Google Doc: everyone can see and verify each update, and nobody can secretly overwrite the history. - How is blockchain different from cryptocurrency?

A cryptocurrency (like Bitcoin) is one application of blockchain technology. The blockchain is the underlying database or ledger. Bitcoin is a digital currency built on a blockchain, but the blockchain itself could record any data. Not all blockchains have cryptocurrencies, though many public chains use tokens to incentivize participants. In short, cryptocurrency is like digital cash; blockchain is the ledger that records it. - Are blockchain networks secure?

Generally, yes. Blockchains use strong cryptography and decentralized consensus to secure data. For example, Bitcoin’s blockchain is protected by thousands of miners worldwide, each verifying transactions through work. Altering a confirmed block would require redoing the proofs for that block and every block after it on every copy of the chain – an impractical feat on a large network. This makes mature public blockchains very secure. (However, smaller or poorly designed blockchains can be more vulnerable. Also, blockchain does not prevent all crime: hackers can still target exchanges or wallets, so caution is needed.) - What is a smart contract?

A smart contract is computer code stored on a blockchain (especially Ethereum) that automatically executes when predefined conditions are met. It’s like a digital vending machine: drop in a coin (a transaction) and the machine (contract) automatically delivers the product. For example, a smart contract could release payment once certain criteria are satisfied. Once deployed, the code is transparent and immutable, and anyone can see its rules and trust it will run exactly as programmed. - What can blockchain technology be used for?

Blockchain has many uses beyond cryptocurrencies. Common examples include supply chain tracking (verifying where food or parts come from), recording land or vehicle titles, managing digital identities, securing medical records, and even running games and social apps in decentralized ways. It is useful in any scenario where multiple parties need a shared, tamper-proof record. Companies and governments use blockchain for food safety, financial services (settlements, remittances), digital voting trials, and more – anywhere trust and transparency matter. - How can I get started with blockchain technology?

Begin by learning the basics – read guides like this one and trusted resources. If you want hands-on experience, you could set up a cryptocurrency wallet and send a very small amount of a popular coin (like Bitcoin or Ether) to a friend to see how transactions work. There are also online tutorials and test networks (e.g., Ethereum’s testnets) for building simple smart contracts. Many online courses and communities offer blockchain training. Remember: use reputable platforms, never share your private keys, and start small as you explore. - How do I keep my blockchain assets secure?

Use a secure wallet (hardware wallets like Ledger/Trezor are safest) and keep your private keys secret. Only use well-known exchanges or wallets with good reviews. Enable extra security (like two-factor authentication) where possible. Treat your private keys or seed phrases like cash: if someone obtains them, they can steal your funds. Never enter your private key into a website or app you don’t trust, and consider splitting large amounts among multiple wallets for safety. - How is blockchain different from a traditional database?

In a traditional database (like a company’s internal ledger), a single organization controls the data and can modify it arbitrarily. In contrast, a blockchain is decentralized: it’s maintained by all participants in the network. No single entity can unilaterally change past records, because doing so would break the chain’s cryptographic links. Additionally, blockchains often include economic incentives for security (like mining rewards). You can think of it as the difference between a privately held spreadsheet (centralized) and a public, shared ledger (decentralized) that anyone can audit.

Leave a Reply